Things about Consolidation Loans

Wiki Article

Excitement About Small Business Loans

Table of ContentsThe Main Principles Of Guaranteed Debt Consolidation Loans Facts About Personal Loans Uncovered4 Easy Facts About Personal Loans DescribedThe Facts About Personal Loan For Debt Consolidation Uncovered

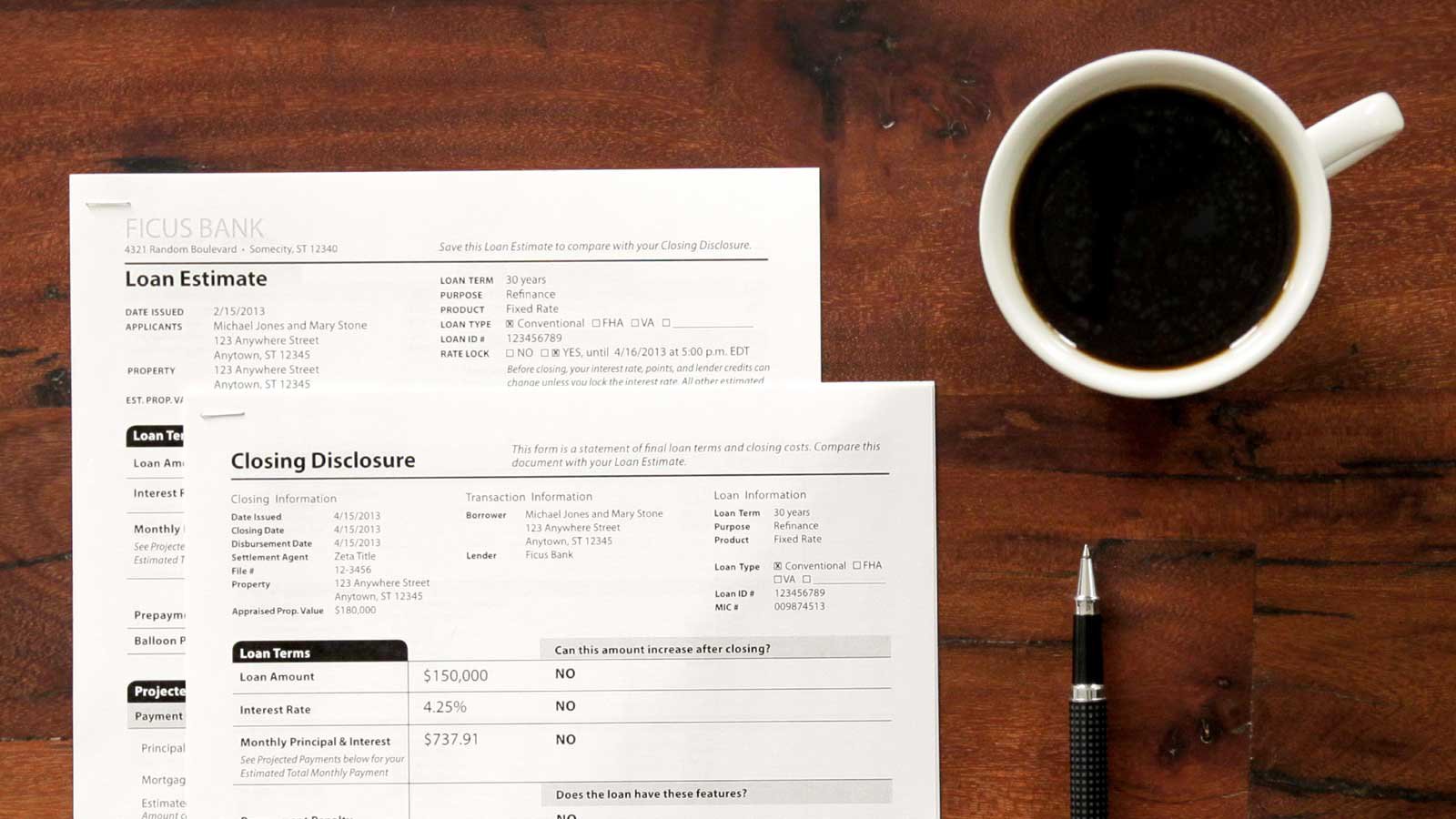

Government-Insured Federal Housing Administration (FHA) Loans Low- to moderate-income customers acquiring a residence for the very first time typically rely on loans guaranteed by the Federal Housing Administration (FHA) when they can't get a conventional car loan. Customers can put down as bit as 3. 5% of the house's purchase cost.The FHA doesn't directly lend money; it guarantees fundings by FHA-approved lenders. There is one disadvantage to FHA car loans. All debtors pay an ahead of time and also yearly mortgage insurance coverage costs (MIP)a kind of home mortgage insurance policy that secures the loan provider from borrower defaultfor the lending's lifetime. FHA financings are best for low- to moderate-income consumers who can not receive a conventional financing product or any person who can not manage a considerable down payment.

5% down payment. (VA) ensures property buyer car loans for certified armed forces service participants, professionals, and their spouses. Customers can fund 100% of the car loan amount with no needed down payment.

The funding cost varies depending on your armed forces service category as well as financing amount. The adhering to service members do not have to pay the funding cost: Veterans getting VA advantages for a service-related special needs, Veterans that would certainly be entitled to VA settlement for a service-related impairment if they didn't obtain retirement or energetic task pay, Making it through partners of experts that passed away in service or from a service-related special needs, A solution member with a recommended or memorandum rating stating eligibility for payment due to a pre-discharge case, A service member who obtained the Purple Heart VA loans are best for qualified active armed forces workers or experts and also their partners that want extremely affordable terms and also a home mortgage item customized to their financial requirements.

See This Report about Small Business Loans

Fixed-Rate Mortgages Mortgage terms, consisting of the length of repayment, are a key consider exactly how a loan provider costs your finance and also your rate of interest. Fixed-rate loans are what they seem like: a collection rate of interest rate for the life of the lending, usually from 10 to three decades. If you wish to settle your home much faster as well as can afford a higher month-to-month repayment, a shorter-term fixed-rate funding (say 15 or two decades) assists you slash off time and also rate of interest settlements.

If you have the cravings for a little danger as well as the resources and discipline to pay your mortgage off faster, a 15-year set lending can save you significantly on rate of interest and reduce your repayment duration in half. Adjustable-rate home loans are riskier than fixed-rate ones however can make feeling if you prepare to sell your home or refinance the home loan in the near term.

An Unbiased View of Personal Loans

These financings can be risky if you're not able to pay a higher month-to-month home mortgage repayment once the price resets. Some ARM products have a price cap specifying that your month-to-month home mortgage payment can not go beyond a certain quantity. If so, crisis the numbers to guarantee that you can possibly handle any kind of payment boosts up to that point.ARMs are a strong alternative if you do not intend to stay in a house past the initial fixed-rate period or recognize that you plan to re-finance prior to the financing resets. Why? Rates of interest for ARMs tend to be less than dealt with rates in the very early years of settlement, additional resources so you can potentially conserve countless dollars on rate of interest settlements in the first years of homeownership.

A lot of these programs are readily available based on customers' revenue or monetary requirement. These programs, which normally supply aid in the form of deposit grants, can likewise save novice borrowers considerable cash on closing expenses. The U.S. Division of Real Estate as well as Urban Advancement (HUD) checklists new homebuyer programs by state.

Mortgages for First-Time Purchasers All these financing programs (with the exception of new homebuyer support programs) are readily available to all buyers, whether it's your first or fourth time buying a house. They can additionally help you better understand the credentials needs, which tend to be complex. An encouraging loan provider or home mortgage broker may likewise provide you homeworktargeted areas of your funds to improveto place you in the toughest placement possible to get a home mortgage and also buy a home.

Report this wiki page